The 2008 Bitcoin Whitepaper painted a vision of a peer-to-peer electronic cash system without the need for a trusted third party. Payments were the original promise. However, today’s infrastructure focuses on the trading instead of supporting real-time payments at scale. So what kind of infrastructure can support payments? What role can PayFi play?

In the interview with Raymond Qu, co-founder of PolyFlow, to obtain answers from a seasoned veteran in this space.

Raymond has over two decades of international finance experience. He founded Geoswift, a comprehensive global financial service company. He is also a prominent investor in the global digital finance space with a profound understanding of blockchain technology from a global perspective.

I. The Genesis of PolyFlow

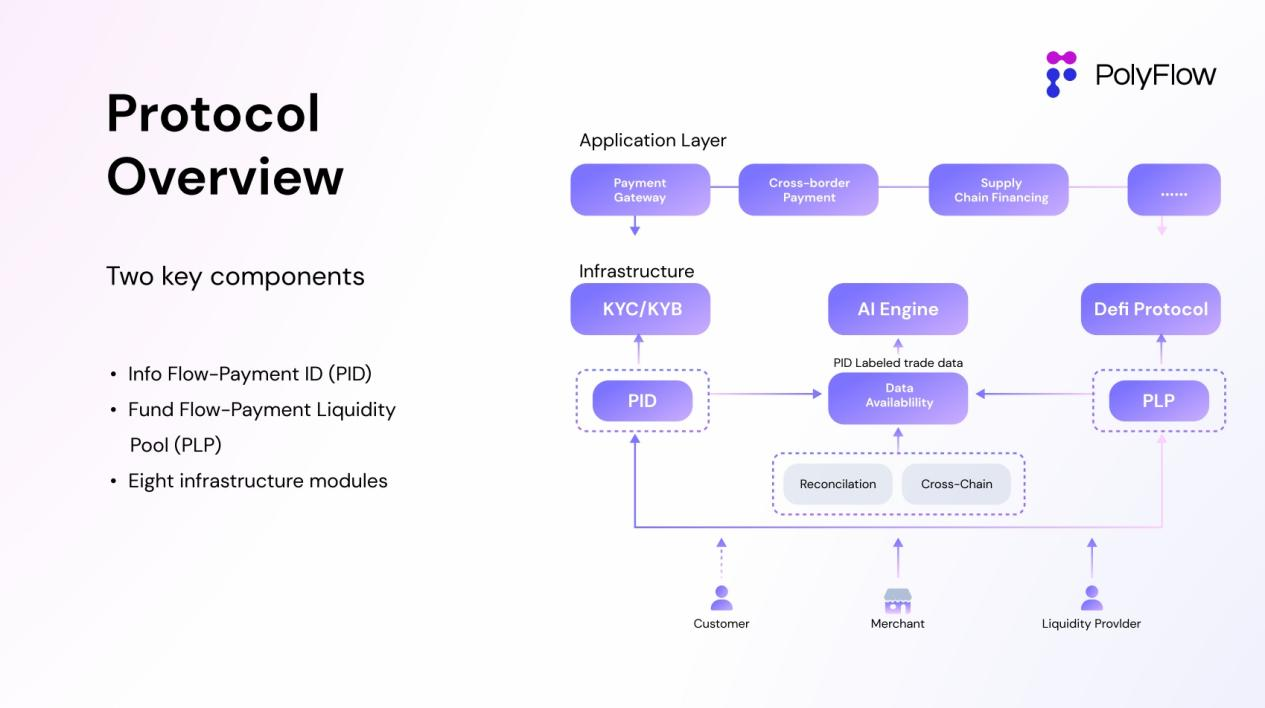

PolyFlow rose from the core concepts of financial transactions: Information Flow and Fund Flow. As the first PayFi, PolyFlow creates a decentralized infrastructure integrating traditional payments, blockchain-based payments, and DeFi. It ensures regulatory compliance, mitigates custodial risks, and connects DeFi ecosystems, promoting efficiency and freedom of value movement. PolyFlow aims to establish a new financial paradigm and industry standard.

II. PID & PLP enables PayFi

PolyFlow introduces two key products: Payment ID (PID) and Payment Liquidity Pool (PLP). Together, PolyFlow creates a compliant, safe, DeFi-compatible business framework for the circulation, custody, and issuance of digital assets.

As Raymond explains, “A PID is more like a wallet that we carry around. Imagine the wallet in our pocket that contains not only cash. It also might hold a family photo (NFT), a bank card (wallet address), an ID (user ZK-enabled information extraction, data privacy protection), and so on… There is much more to be expected from PID. The current Scan to Earn project built around PID is one of them.”

As for PLP, the purpose is to consolidate fund flows, solving unaddressed issues. Raymond elaborated on three settlement modes to illustrate how PolyFlow helps.

Peer-to-Peer Mode

Raymond explained, “The current technology cannot handle transaction-by-transaction accounting. In traditional finance, the ledger is only between the two counterparties, but in blockchain networks, every transaction needs to be recorded by the entire network.”

So how do we build a new settlement model for blockchain-based payments? Raymond stated, “Our original answer was to trust in technological progress. With increased computing power, payment efficiency will eventually catch up. But we cannot rely on future technology to solve today’s problems. We need to address the issue by solving it at the core-by building consensus around fund flows.”

Net Settlement Mode

Raymond clarified, “In this scenario, the actual movement of underlying funds is minimal. What is happening is the continuous exchange of information..”

Net settlement can significantly reduce transaction costs, improve efficiency, reduce counterparty risk, and enhance capital utilization. However, this model requires a centralized trust system with the risks of custodianship and lack of transparency.

To replicate this efficient method of net settlement in blockchain while removing the risks, PolyFlow developed PLP to pool funds on a unified blockchain ledger. The goal is to allow participants to cooperate and verify each transaction’s authenticity without implicit trust in the counterparty.

PayFi Mode

Once consensus is reached around fund flows on the blockchain ledger, we can fully embrace PayFi. With the trust issue resolved, parties can move from daily net settlement to simply paying each other overnight interest for the use of funds. This mode further enhances liquidity.

In the PayFi mode, capital efficiency reaches a new height. Since all parties’ ledgers are unified on the blockchain, it allows real-time verification of transaction details, addressing any funding gaps.

III. PayFi’s Value and Significance

Ever since Lily Liu, President of the Solana Foundation, introduced the PayFi concept at the Hong Kong Web3 Carnival, PolyFlow has been recognized as one of the first protocols designed to build PayFi’s financial infrastructure.

When talking about PayFi, Raymond has a deeper understanding: “What PayFi solves is not the problems that blockchain-based payment needs to solve on the surface. It needs to solve the most fundamental problem at the moment: effectively separating the information flow of the transaction from the fund flow, so that we can form a unified ledger of the flow of funds on the blockchain. Reach consensus for flow of funds on this unified ledger and enhance the efficiency of the entire Web3 industry, to promote real mass adoption.”

Contact Email: kim@polyflow.tech

Name: Kim Shera

City: Vancouver, Canada

Website: https://polyflow.tech/

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Finance Zeus journalist was involved in the writing and production of this article.